The 2021 Total Workforce Index Report

Differentiating and diversifying workforce strategies to create the right combination of skills, workforce mix, and labour markets will help organizations face rapidly evolving markets. The annual analysis of the Total Workforce Index™ scores 75 global workforce markets based on over 200 unique factors. From the TWI data, ManpowerGroup Talent Solutions develops country and regional profiles based on how markets score in each of the four categories (Workforce Supply, Cost Efficiency, Regulation and Productivity).

The Total Workforce Index™ measures the relative ease of sourcing, hiring and retaining a workforce in competing labour markets around the world. The Total Workforce Index™ compiles more than 200 key factors that relate to the Workforce Supply, Cost Efficiency, Regulation and Productivity of the workforce of each market.

Total Workforce Index™ rankings provide important perspectives and insights that can influence both short- and long-term strategies involving workforce procurement, including:

Remote Work Allocation

Organizational Restructuring

Location Strategy

Direct Sourcing Strategy

Crowdsourced Sourcing Strategy

Capacity Planning

Diversity and Inclusion

Workforce Mix

Cost Savings

Compliance

Why is the Total Workforce Index Important?

Organisation's are aggressively pursuing growth opportunities in the midst of the tightest labour market in 80 years. ManpowerGroup’s Q4 2021 Employment Outlook Survey confirms hiring intentions are at their highest since prior to the pandemic, yet a record number of companies report struggling to find the skills they need. The survey data suggest it has never been more difficult to attract, activate and retain growth talent. Meanwhile, 69% of employers globally say they are having difficulty filling roles due to a lack of skilled talent--running at a 15-year high.

Differentiating and diversifying workforce strategies to create the right combination of skills, workforce mix, and labour markets will help organizations face rapidly evolving markets and workforce challenges. The Total Workforce Index (TWI) provides a vital edge in the race for talent focusing short, medium, and long-term investments in labour markets with the most potential in sectors or skill sets that will shape the post-pandemic world.

This year’s TWI provides clarity amidst these complex challenges (e.g., record talent shortages, the continued pandemic impact, and adapting to the New Normal) by focusing on 3 key emerging themes that are impacting labour markets around the world:

1) learning is a core requirement to secure talent for growth;

2) wage inflation in mature markets can be hedged by accessing new markets; and

3) contingent labour is becoming an essential sourcing strategy.

As organizations focus on returning to growth, ManpowerGroup Talent Solutions can help organizations attract, assess, develop, and retain talent. Organizations should access the TWI microsite to explore the data while also downloading the summary report to access the insights that--when used together -- will give organizations an edge over the competition.

Audiences will also be guided to request a comprehensive custom analysis based on the factors most important to their organization as well as messaging and CTAs that connect the data and insights to Talent Solutions’ workforce consulting offerings—remote work optimization, workforce mix, compensation analysis and location strategy.

How Did Ireland Perform in the 2021 Analysis?

Ireland ranked 8th overall in the analysis of 75 countries.

Ireland ranked 4th in Europe for workforce quality.

Ireland ranked 29th overall for Remote Work Suitability which is lower than might be expected given Irelands position as a global employer.

40% of the Irish workforce is Highly Skilled (e.g. white collar).

Ireland ranked 9th of the countries measured in terms of Gender Gap (a very positive result).

9% of the workforce is classed as Informal Workers (or gig economy as sometimes referred to).

Average Monthly Wages was found to be €3,965.

Ireland also ranks well in areas of Productivity and Ease of Doing Business.

Some other key wage findings for Ireland include:

Ireland has the 2nd highest Tech & IT wage levels in the EMEA region behind only Denmark

Ireland has the 7th highest average wages in the EMEA region overall

Ireland's Manufacturing wages are also high ranking 7th in the EMEA

Irelands Employment Taxes are deemed favourable in the report for employees with Ireland ranking 7th in the study behind the UK in 6th

DOWNLOAD THE FULL IRELAND MARKET PROFILE HERE

Key Findings from the TWI Report for your Business?

The Total Workforce Index enables organizations to optimize workforce investments and access needed skills, giving them a vital edge in the race for talent---the ability to see around corners, and focus short, medium and long-term investments will shape the post-pandemic world.

An emerging threat to competitiveness—both for individual organizations and economies—is the lack of “growth talent.” Growth talent offers competencies that expand digital transformation, accelerate speed to market and deepen product or service personalization. 69% of employers globally say they are having difficulty filling roles due to a lack of skilled talent--a 15-year high. (ManpowerGroup 2021 Talent Shortage Survey).

The business challenges impacted the most by lack of growth talent, include:

Digitization of business models or processes: Digital transformation and automation of routine tasks are escalating demand for higher skilled workers.

Speed-to-market and operating agility: The ability to compress time-to-market depends on access to a wider range of skills.

Personalization of products and services: Meeting consumers’ evolving expectations for more personalized experiences require high-level, hard-to-find information and analytics capabilities.

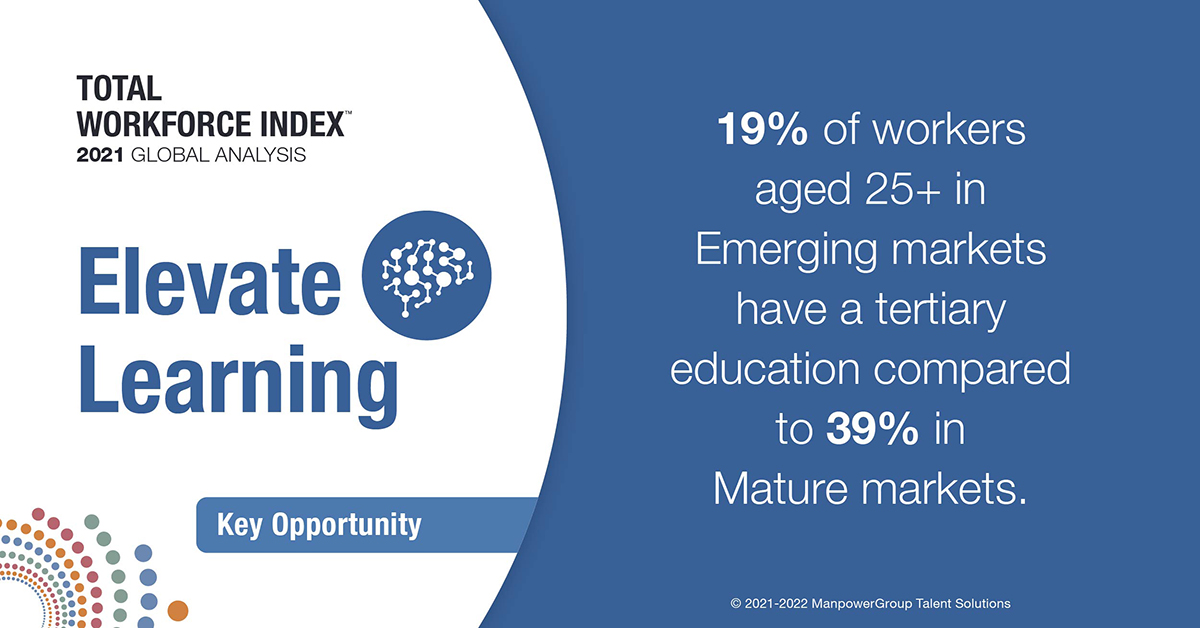

1. Elevate learning as a core benefit in all labour market types: the ability to secure talent needed for growth, especially in Emerging markets, is likely to depend increasingly on compensation strategies and skills development offerings.

20% of workers in Emerging markets are highly-skilled (40% in Mature markets) with only 19% of workers aged 25+ in Emerging markets having a tertiary education compared to 39% in Mature markets.

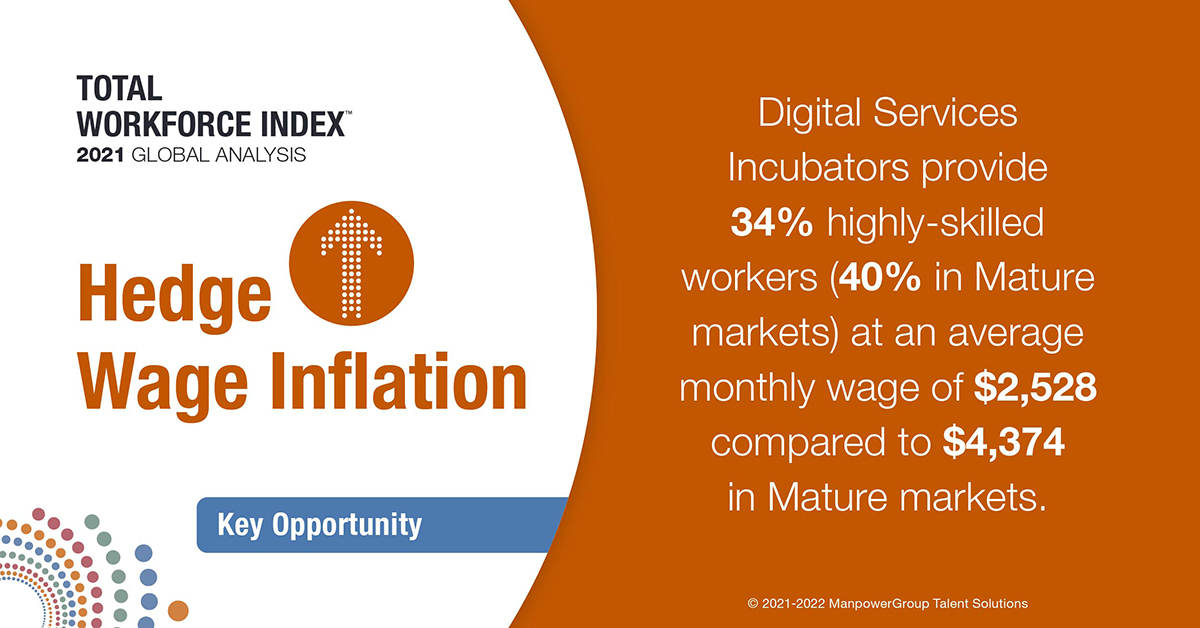

2. Segment Incubator markets to hedge wage inflation in Mature markets: Incubator markets hold the potential to supply highly skilled growth talent to specific fast-growing industries at cost-competitive rates while contributing to longer-term talent sustainability.

The average monthly wage for Advanced Manufacturing Incubator markets, for example, is US$2,314 with 34% of the workforce highly skilled; whereas; the average monthly wage in Mature markets is US$4,374 with approximately 40% of the workforce highly skilled—only slightly higher than in Emerging markets.

3. Integrate contingent labour as an essential sourcing strategy: contingent labour augments permanent work and offers access to highly skilled workers choosing to work in more flexible ways.

Demand for contingent work has increased by 9% in the past year, and within that, high-skilled contingent work in Mature markets is 40% on average.

The average TWI Remote Readiness ranking for countries with a highly skilled contingent workforce is 21, compared with 47 for all other countries.

The Optimal Workforce Investments(e.g., skills, workforce mix) for an organization are being influenced by the realities of 3 labour market types(Mature, Emerging or Incubator). For example:

The 20 Mature markets have an average of 40% skilled workers

The 31 Emerging markets comprise at least 50% of the total labour pool.

Digital Services Incubator markets have an average of 34% skilled workers with 41% being Gen Z and Millennials

DOWNLOAD THE FULL TWI GLOBAL INDEX REPORT HERE

VISIT OUR WEBSITE TO SEE MORE INSIGHTS AND TRENDS