RECORD HIRING IN BANKING & FINANCE SECTOR Q3 2022

DUBLIN HIRING INTENTION HITS ALL-TIME HIGH

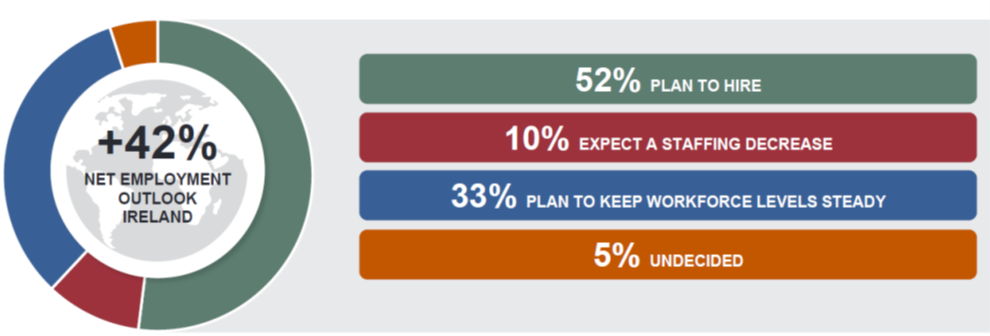

Irish Employment Outlook highest in Europe with +42% of employers intending to hire

Ireland’s Finance sector sets record-breaking +50% hiring intention

Dublin’s Employment Outlook at an all-time high of +48%

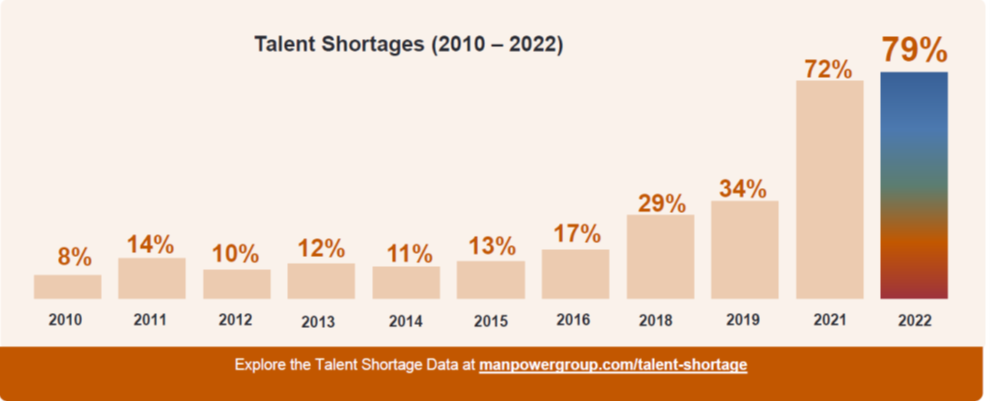

Despite strong growth, 79% of businesses are struggling to fill vacancies

DUBLIN, 19 May 2022 – Irish employers report highest Q3 hiring intentions since the survey began in 2006, according to the latest ManpowerGroup Employment Outlook Survey. In the third quarter of 2022, employers of all sizes plan to expand headcount significantly, driving the national hiring Outlook to +42%, up 10 percentage-points on last quarter, and an increase year-on-year of 24 percentage-points. Ireland has recorded the highest Net Employment Outlook in Europe, followed by Finland (+36%) and the Netherlands (+35%).

The ManpowerGroup Employment Outlook Survey is based on responses from 425 employers across Ireland. It asks whether employers intend to hire additional workers or reduce the size of their workforce in the coming quarter. It is the most comprehensive, forward-looking employment survey of its kind in the world.

The Banking, Finance, Insurance and Property sector is seeing the highest Net Employment Outlook since records began in 2006 (+50%), up 17 percentage-points on last quarter and up 40 percentage-points year-on-year. “The Finance sector is a leading player in the thriving Irish employment market” said John Galvin, Managing Director, ManpowerGroup Ireland. “Dublin’s financial sector – home to over 400 financial institutions operating globally – has become known internationally as a business-friendly hub for finance firms. Just a year on from Ulster Bank and KBC announcing they would be leaving the Irish banking market by the end of 2022, and amidst rising inflation, pandemic aftershocks, and the economic impact of the conflict in Ukraine, the strong hiring intention in this sector is a huge vote of confidence in both Ireland’s financial market and in business across the economy.”

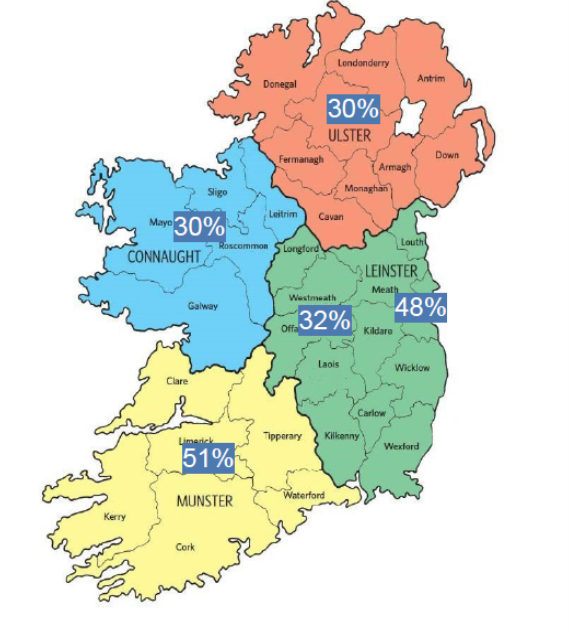

Employers in Dublin report a hiring Outlook of +48%, up 19 percentage-points on last quarter and the City’s strongest hiring intention on record. Outside the Capital, Munster (+51%), Ulster (+30%), Connaught (+30%), and Leinster (+30%) follow this robust hiring trend.“ Dublin is continuing to cement its position as a global city of business activity,” continues Galvin. “The Capital’s record hiring is driven by the ever-strong IT & Tech sector holding its strong performance from last quarter and is boosted by all-time high hiring Outlooks from the Dublin-based Finance Sector, Hospitality sector, and Construction sector. This strong performance is echoed across Ireland’s regions, nowhere more so than in Munster. We see this a big vote of confidence in the Irish economy as we enter the third quarter.”

Despite record-setting hiring intention across Ireland, our data shows +79% of employers are having difficulties filling vacancies, which is up 7 percentage-points on last quarter. Galvin concludes: “As evident in markets across the world, employers are struggling to find applicants with the right skillsets for their needs. Candidates with in-demand skills have more choice and bargaining power than ever before, and employers need to look at talent-sustainable solutions if they want to attract and retain these candidates. That means improving their attractiveness to skilled candidates by investing in new training and advancement opportunities, upskilling employees, and making new job opportunities more candidate friendly with benefits like hybrid working and flexible hours.”

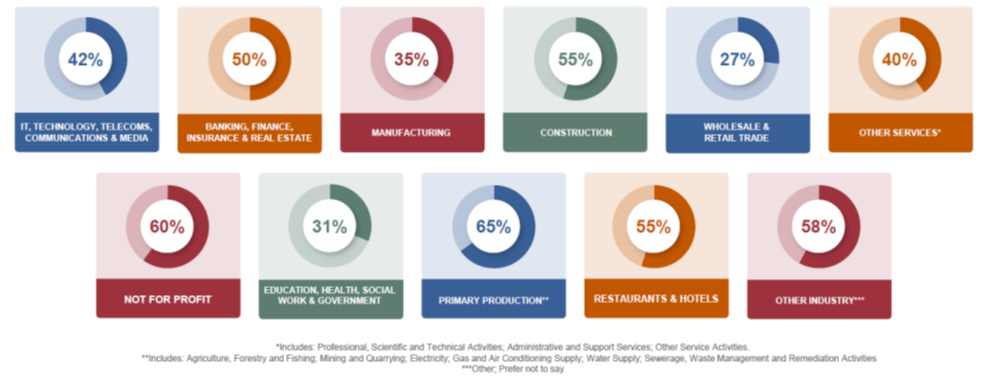

Irish Hiring Plans by Industry, Region, and Employer Size:

Banking, Finance, Accounting and Real Estate (+50); Restaurants and Hotels (+41) and Construction sectors (+55) all report record breaking Net Employment Outlook for Q3.

Across the sectoral breakdown we see the following: Primary Production (+65%), Other Industry (+58%), Construction (+55%), Banking, Finance, Insurance and Real Estate (+50), IT, Tech, Telecoms, Communications and Media (+42%), Restaurants and Hotels (+41%), Other Services, (+40%), Manufacturing (+35%), Education, Health, Social Work and Government (+32%), Wholesale and Retail Trade (+27%) From a regional perspective Outlooks in Munster were (+51%), Dublin (+48%), Leinster (+30%), Connaught (+30%), and Ulster (+30%).

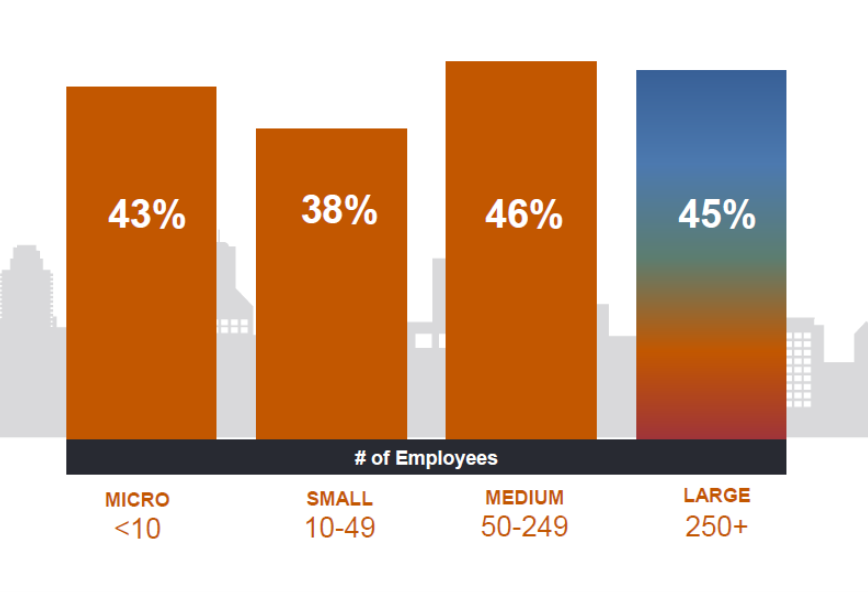

From an employee size perspective, Micro (1-9 employees) +39%, Small (10-49 employees) +36%, Medium (50-249 employees) +42%, Large (250+ employees) +45%.